FANNIE MAE AND FREDDIE MAC INTEREST RATES TODAY SERIES

Monthly gross (before tax) income of your household, including recent pay stubs if you receive them or documentation of income you receive from other sources .), today announced a series of changes to the Home Affordable Refinance Program (HARP) in an effort to attract more eligible.The change, beginning on September 1, adds 0.5 of. Account balances and minimum monthly payments on all of your credit cards and any other debts such as student loans and car loans Fannie Mae and Freddie Mac announced a new fee of 0.5 to protect themselves from losses on their refinanced mortgages given ow interest rates.Information about a second mortgage or home equity line of credit.

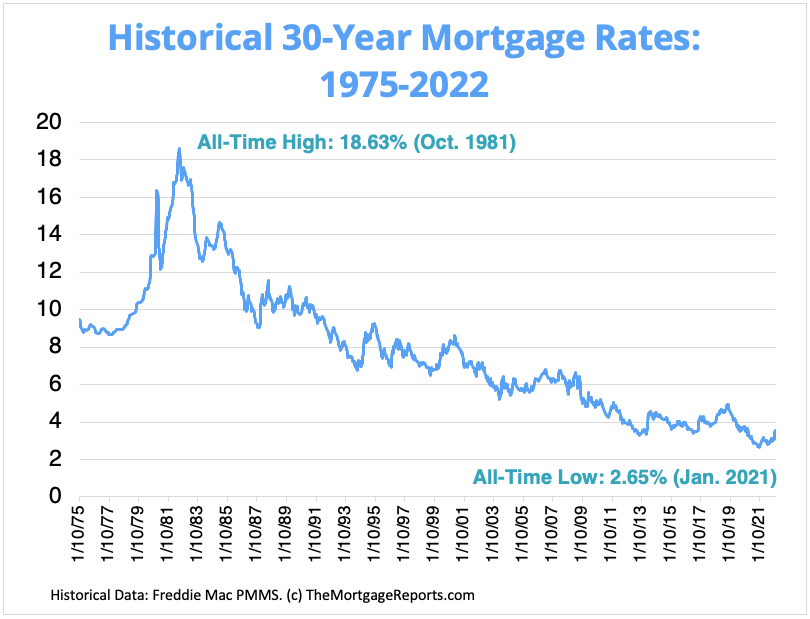

Mortgage information, such as your monthly mortgage statement.The FHFA announced that its adding the new fee to build capital for Fannie Mae and Freddie Mac and reduce the. Use this checklist to ensure you have all the information you will need when you speak to your mortgage company or homeownership counselor: Fannie Mae also became even less popular in 1970 when Congress created Freddie Mac to compete with Fannie Mae. INTEREST RATES EXPECTED TO RISE IN JANUARY, EXPERT SAYS.

In just a few simple steps, you'll be on your way to contacting your mortgage company with confidence. The Home Affordable Modification may provide them with mortgage payments they can afford. The ESR Group also won the award in 2015, marking the first back-to-back win in the history of the award. In 2016, Fannie Mae’s Economic & Strategic Research Group won the NABE Outlook Award presented annually for the most accurate GDP and Treasury note yield forecasts. Many homeowners are struggling to make their monthly mortgage payments either because their interest rate has increased or they have less income. Fannie Mae Receives Top Honors for Most Accurate Forecast. The Home Affordable Refinance may help borrowers, whose loans are held by Fannie Mae or Freddie Mac, refinance into a more affordable mortgage. march 2022 30 year fixed mandatory delivery commitment mandatory delivery commitment 30-year fixed rate a / a. Many homeowners pay their mortgages on time but are not able to refinance to take advantage of today's lower mortgage rates, perhaps due to a decrease in the value of their home. If you are struggling to make your mortgage payments or can’t take advantage of lower interest rates because your home has dropped in value, you may be eligible for the Making Home Affordable Program, which is intended to help responsible homeowners and strengthen the housing market.

0 kommentar(er)

0 kommentar(er)